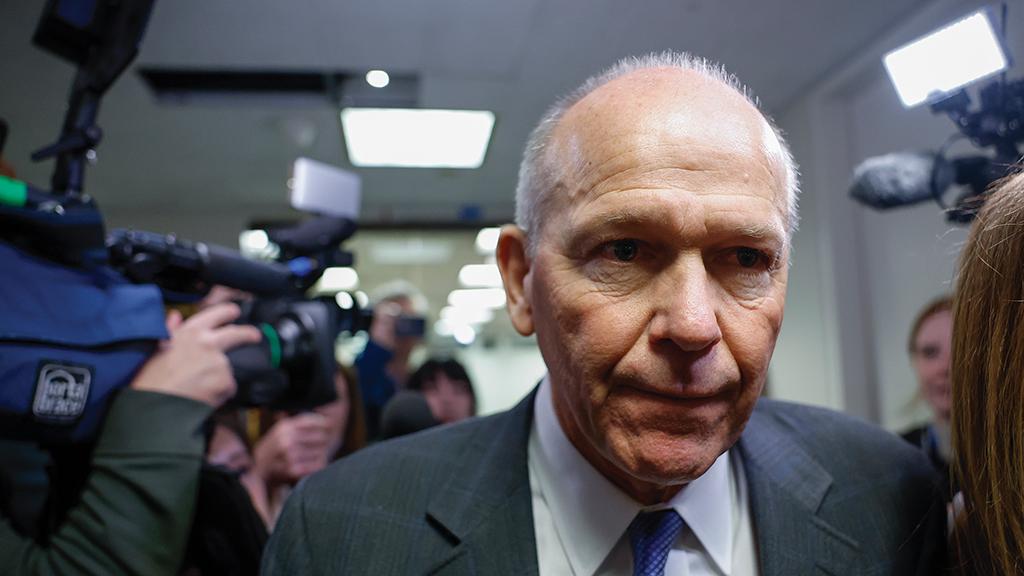

Boeing CEO David Calhoun.

In an interview with CNBC in March, Boeing CEO Dave Calhoun (pictured) doubled down on his estimate from November 2022 that a new narrowbody airplane would cost $50 billion to develop.

The amount surprised many industry veterans and independent observers, given that it is pricier than the Boeing 787 widebody, where the peak (deferred) cost of development was an estimated $32 billion. Calhoun’s assumption that Boeing’s next aircraft will be less successful in cost control and project management than its previous major program seems an unsettling way to advertise the prowess and products of any engineering company.

Time is money, and increased certification oversight and requirements have extended development cycles for Boeing and Airbus over the past two decades from 5-6 years in the 1980s and ’90s to more than eight years today. But it is hard to escape the conclusion that Calhoun’s $50 billion estimate at least partly is intended to explain Boeing’s inaction since the 737 MAX program was launched nearly 13 years ago.

The MAX was intended as a low-cost derivative, but based on its 40% market share against Airbus’ A320neo family, it has failed to protect Boeing’s historic leadership in narrowbodies. By deploying a big cost estimate to replace the MAX—coupled with overly high thresholds for improved performance—the company, in effect, has deflected calls from customers—and, increasingly, investors-—for a new narrowbody to restore Boeing’s competitiveness in what is now the most important segment of the civil airliner market by far.

An even bigger problem is that putting a $50 billion price tag on a new aircraft program damages the broader industry far more than any benefit Boeing gains by justifying its lack of spending. Were such a number to gain credibility among investors, it could deter Airbus from launching a new model.

A hiatus in aircraft development spending might benefit Boeing financially in the short term. This is a duopoly, after all. But since the dawn of the jet era more than 60 years ago, airlines have benefited from the continuous development and fielding of new technologies that reduce fuel burn and operating costs. Telling key customers they will be taking deliveries of essentially the same 737 MAX or A320neo in 2035 as they are today—with, at best, a few tweaks to the engines—essentially would break the original aircraft manufacturers’ commitment to the growth of aviation.

It also could damage the implicit “license to fly” that societies and their governments grant to the industry. Commercial aviation appears more and more overcommitted to so-called “sustainable aviation fuel” to deliver the industrywide reductions in emissions needed to reach net zero. Putting off further major product launches, whether for fear of the cost or in hopes of achieving future performance improvements, increases this risk. Business aviation already is starting to see a reduction in societal tolerance, especially in Europe. And continued legal battles in the Netherlands over noise pollution at Amsterdam Airport Schiphol have led to the imposition of slot restrictions that weaken the airport as a hub and the airlines that depend on it.

Fortunately for aviation, innovative companies have developed new aircraft at acceptable costs recently. Embraer consistently has led in this field, having developed the E2 Jets in less than five years and spending as little as $5 billion to develop the entire family of E-Jets. Similar steady spending on R&D and new products—around 8% of annual sales—has kept Gulfstream the clear leader of the large business jet market, while Bombardier managed to develop the C Series (now the Airbus A220) for about $6 billion.

These successes are clear challenges to the “too big to fail/too expensive to launch” ethos. Imagine how much stronger this will be when JetZero flies its narrowbody-size blended wing body demonstrator for the U.S. Air Force in 2027. The aviation industry cannot afford to price itself out of continued strong reductions in operating costs and emissions by accepting an excessive estimate for the cost of a new airliner. It is a good thing for the industry that other companies and talented engineers will challenge such a number—and possibly also the corporate model that generated it.

Comments

the next quarter's profit and their salary. The long run/future technical brilance and manufacturing perfection are IMHO hollow terms for them.

the next quarter's profit and their salary. The long run/future technical brilance and manufacturing perfection are hollow terms for them. Greed and risk aversion are the name of the game.

the next quarter's profit and their salary. The long run/future technical brilance and manufacturing perfection are hollow terms for them. Greed and risk aversion are the name of the game.

It is clearly time for further significant changes in the "frozen middle" of the Boeing engineering team and development of a culture that understands that robust design is hard, there are no shortcuts, and understands that success is driven from manufacturable designs.

Perhaps the greatest failure of keadership was the failure to acquire commercial Embraer.